Decarbonizing the transportation industry, in part through the wider adoption of EVs, will be key to reach the US’s net zero goal by 2050.

The EV industry is still relatively small, but has been experiencing rapid growth, with total U.S. sales, including PHEVs (Plug-in Hybrids) and BEVs (Battery Electric Vehicles), reaching ~1.1 million units in 2022 or 6.7% of total US car sales, up from only ~308,000 in 2020 and ~18,000 in 2011.

This growth is expected to continue and even accelerate going forward.

Decarbonizing the transportation industry, in part through the wider adoption of EVs, will be key to reach the US’s net zero goal by 2050. The EV industry is still relatively small, but has been experiencing rapid growth, with total U.S. sales, including PHEVs (Plug-in Hybrids) and BEVs (Battery Electric Vehicles), reaching ~1.1 million units in 2022 or 6.7% of total US car sales, up from only ~308,000 in 2020 and ~18,000 in 2011. This growth is expected to continue and even accelerate going forward.

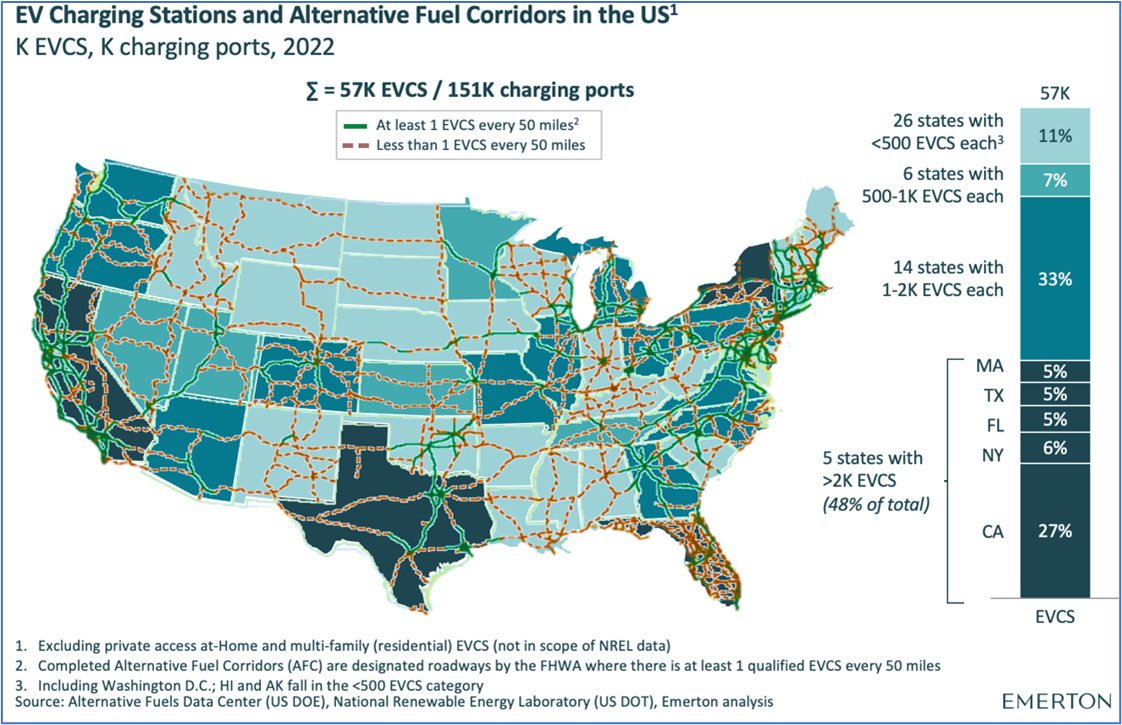

With a growing EV market comes the need, and opportunity, for a solid supporting infrastructure. Specifically, public charging infrastructure is essential to support the needs of EV drivers. Although there are already ~57K charging stations (EVCS) and ~151,000 charging ports in the U.S., roughly 30x the amount available in 2011, the current infrastructure is considered “not nearly robust enough to fully support a maturing electric vehicle market” (S&P Global Mobility). In other words, the growth of the EV charging infrastructure is too slow compared to the adoption of EVs.

In particular, the US is plagued with charging deserts: only five states have over 2,000 EVCS, and most states have less than 1 EVCS every 50 miles.

Although the U.S. is widely considered a pioneer in EV technology, it is actually behind when compared to other developed nations. It trails its European counterparts in terms of EVs per capita and EVs per charging port (the more EVs per charging port, the more constrained the infrastructure). In fact, its equipment rate of public access charging ports is only half of what it is in the average EU country. The US needs to catch up to world-class standards.

What’s more, U.S. driving patterns are very conducive to EV adoption and therefore, the development of the EVCS infrastructure:

The average distance driven per person in a year is 14,000 miles in the U.S., roughly twice as much as it is in Europe.95% of car trips in the U.S. are within 30 miles whereas EVs have a range of 291 miles, on average.2. Constraints with the development of EVCS infrastructure

A first constraint with the development of the EVCS infrastructure is utility fragmentation: the power utilities market is very fragmented in the US, with regional operators often having monopolies. New entrants will thus have to deal with potentially many local specificities and providers of EVCS infrastructure will need to seek to partner with multiple grid operators to expand their reach.

A second constraint is the type of EVCS in place. In order for EVs to fully compete with gas-powered cars and develop further, they must have the ability to complete long-distance trips and charge quickly. But currently, 90% of EVCS are only capable of charging 50% of a 60kWh battery in 4 to 5 hours (“level 2 chargers”); fast chargers (which can reach the 50% charge threshold in 15 to 30 minutes) only account for 10% of all charging stations in the US.

A vicious circle linked to these two constraints will need to be broken in order for EVs to reach their full potential and make an investment in infrastructure a no-brainer opportunity. One way to break it is through government subsidies.

The U.S. has set very ambitious targets for EVs, expecting 50% of car sales to be electric by 2030. It is also heavily investing in infrastructure to reach this goal. More specifically, the Biden Administration aims to reach a network of 500,000 open-access EVCS by 2030. Some experts expect the growth will be even higher.

Early 2023, the Federal Government has unlocked investment in the development of the EVCS infrastructure, particularly through the Bipartisan Infrastructure Law, also referred to as the Infrastructure Investment and Jobs Act (IIJA), which apportioned $7.5B over 5 years to develop such infrastructure.

Those funds comprise $5B for the NEVI Formula Program, and an additional $2.5B for the CFI Discretionary Grant Program. The NEVI Formula Program aims to grow a publicly accessible EV infrastructure located within 1 mile from Alternative Fuel Corridors, which are roadways designated by the FHWA to have 1 open access, fast-charging EVCS at least every 50 miles. In addition, the CFI Discretionary Grant Program is designed to deploy EV, hydrogen, propane, and natural gas infrastructure in rural, underserved, and overburdened communities.

Funds are allocated on a state-by-state basis. For the NEVI Formula Program, states will be receiving a set amount between 2022 and 2026 and must administer funds via a competitive grant selection. They are required to follow certain guidelines, which specify how funds should be distributed, who can retain ownership of the projects, and more. New EVCS will also be subject to requirements regarding accessibility, availability, charging capacity, pricing, and origin of the equipment. As for the CFI Discretionary Grant Program, they are distributed to local administrations who apply for the program. Applications for the first round of funding have opened in March 2023.

Exclusivity, in most cases, is likely to occur for EVCS players. Recipients of federal funds will gain a clear competitive advantage over non-recipients due to lower deployment costs, so non-recipients are unlikely to directly compete with recipients. Moreover, on toll roads, local authorities often choose the same operators for their service areas and prohibit the construction of new ones, so EVCS players who install stations on service areas are unlikely to face much competition. On non-toll roads, drivers are also more likely to stay within certain specific zones, particularly around major roads like highways. Combining those location characteristics with receiving federal funds would give any EVCS player a de facto exclusivity in their area. States may even include local exclusivity clauses in their policy, as is the case in Pennsylvania.

The industry, in its infancy, has several groups of stakeholders, all jockeying for position along the value chain, alone or with partners.

Several stakeholders have already partnered up to launch their own initiatives and boost EV adoption and the development of the EVCS infrastructure. For instance, BP Pulse has partnered with Hertz and made a $1B commitment to achieve a goal of 25% EVs in Hertz’s fleet by 2024. Electrify America and Travel Centers of America have committed to installing 1,000 charging ports across 200 EVCS within 5 years, while EVgo, Pilot Flying J and General Motors have committed to 2,000 ports across 500 travel centers.

Moreover, network providers like ChargePoint are likely to play a major role going forward due to their potentially large coverage of the value chain. Depending on the situation, they may act as equipment manufacturers, develop the required software, manage operations and maintenance, and own or lease the infrastructure, while managing the full customer experience.

For stakeholders, key drivers and metrics shall determine the attractiveness of the local opportunities. In addition to subsidies from the US government, KPIs will need to include the traditional determinants of Revenue (usage rate, pricing, etc.), CapEx (infrastructure, equipment, installation) and OpEx (networking, maintenance, rental). But most importantly, electricity prices will be a key determinant of profit, and they tend to vary greatly between states on the one hand and can be subject to high volatility on the other hand.

An example of EVCS planning can be seen in Pennsylvania. Pennsylvania is the first state to launch the RFP process for NEVI funds and will fund a single private player per ‘interchange group’. Interchange groups are classified as Priority 1, 2, or 3 groups, depending on their need for new infrastructure. Each interchange group has multiple interchanges for which applicants can apply. One winning applicant within each group will receive funding for one EVCS and have funding exclusivity in the group’s area.

The following shows the breakdown of Pennsylvania’s criteria for the NEVI grant selection. Of 100 points, interchange selection within the group accounts for an important 16 points:

Therefore, location of stations is key. Pennsylvania seems to allocate more points to interchanges with existing facilities like quick-service restaurants, so current site owners are also likely to play an important role in the deployment of a robust EVCS infrastructure.

In sum, the EV charging infrastructure is poised for high growth in the US, but it is still facing certain uncertainties, including EV adoption rate, charging station utilization and electricity prices. In addition, as consumption will increase, the US electric grid will have to follow: “Utilities will likely need to build a lot of new power plants and upgrade their transmission networks” (The New York Times).

Investors who want to invest in the EVCS infrastructure in the US will need to answer several questions around where to invest, with whom to partner, and how to win in a burgeoning industry.

What states have favorable regulations, EV growth potential, high traffic, unmet needs, expected grants, etc.?

What locations/sites should be established? (charge-only sites, gas stations, retail)How scalable is the business/opportunity?

Which elements of the value proposition are critical/differentiating?What could be the size of the opportunity (sales, margins)?

What is the customer’s lifetime value?What are the risks? (e.g. sustainability of subsidies, management of electricity prices, emergence of disruptive propositions)

What would be the most relevant types of stakeholders? (i.e. network provider, operators, OEM, grid operators, franchise developers)

Which players are relevant and open to a partnership?

How can a partnership be structured and leveraged?

What site owners could be considered for an association?

What government entities can relationships be established with?

What are the end-game scenarios that can be foreseen?

Is there a first-mover advantage?

What business model(s) should be implemented?

What are the economics / business plan of the targeted EVCS project (revenue, CAPEX, OPEX…)?

How can key assumptions be stress-tested and benchmarked?What other revenue streams can be developed? (e.g., advertisement revenue)

What access type / technology / payment method / network status / station size is preferable?